Financial Advisor Blog

Financial Advisor Blog

Targeted

If you’re a client of ours or have spoken with us about investments in the last several years, you’ve likely heard us say we do not love target date funds, because they have never done what people think they’re intended to do, and because they’re costly. The primary selling point for target date funds is

What Inflation Is All About?

Greetings From Snowy South Burlington! We hope you all had a safe and relaxing Thanksgiving with friends and family. We double-checked the calendar this morning to see when winter officially starts because it sure feels like the switch has been flipped and winter is here now (if you were about to go search it yourself,

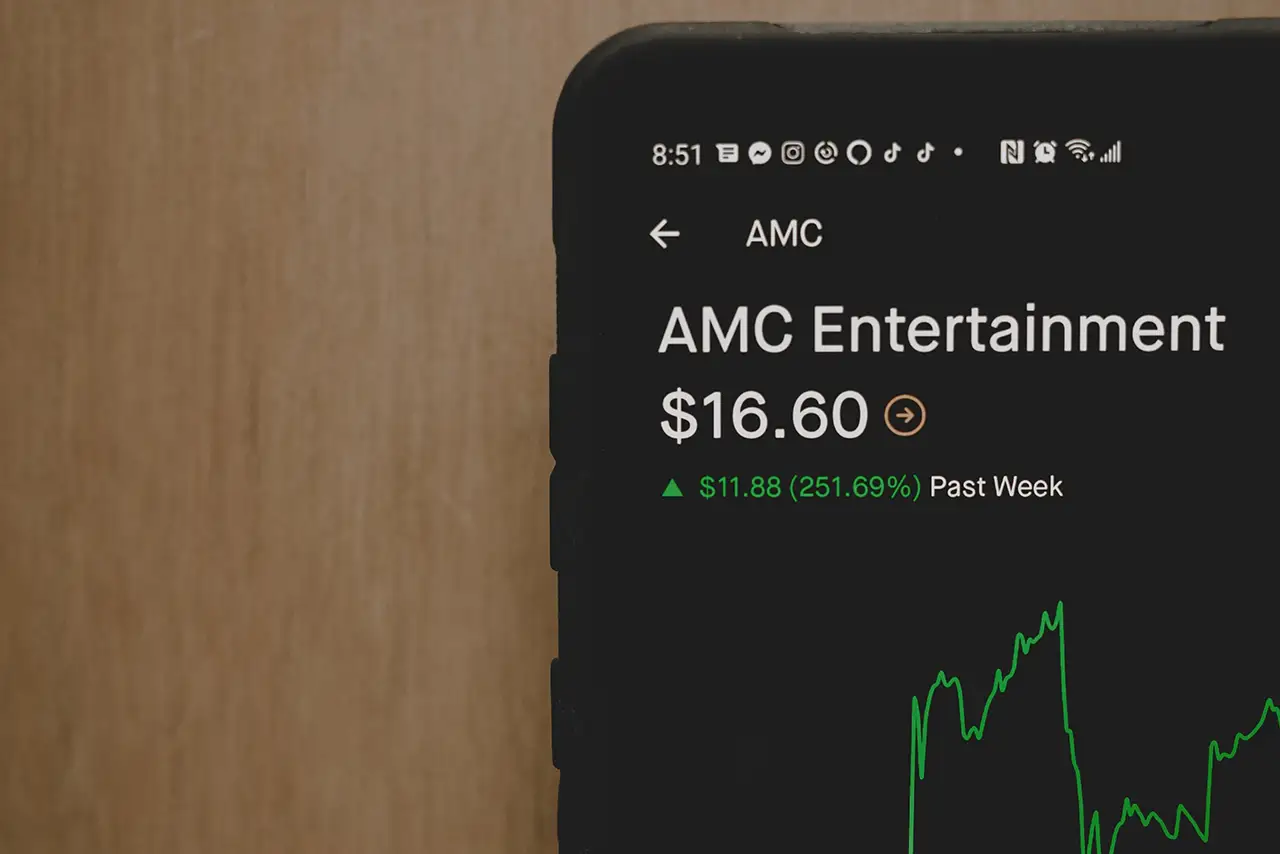

Betting the House

We are continually reminded by conversations we have with others just how vulnerable we all are to the lure of advances in broad stock market indexes. In a common exchange, we’ll remind people of the pain they experienced in 2008 and suggest reducing risk by paring down stock and bond holdings and keeping more cash

Take This Job

Apparently, a global pandemic that, temporally speaking, follows on the heels of a Global Financial Crisis, has a tendency to make people think twice about what they want to be when they grow up. Case in point: if you read the news, you know a lot of people have been quitting their jobs recently. Recently,

Head Fake or Bursting Bubble?

Is the recent action in markets the beginning of a downturn, or just a temporary pause? That is the $64,000,000,000,000 question;$64,000 just doesn’t seem to do it justice anymore (yes, I know I’m dating myself here). Mark Twain said, “History doesn’t repeat itself, but it does rhyme.” In the graph below, it may not be

The Struggle for Balance

We all struggle for balance in almost all areas of our lives: balance in our diets, our work, and personal interests: our spending and saving: and of course, our investment allocations. We instinctively understand the conceptual value of balance in our investments, but finding and maintaining it is elusive. Our struggle for balance develops because

Are You Exuberant?

I don’t think Jimi Hendrix and Alan Greenspan would have ever hung out, but I do think if they’d met by some kind of happy accident, they’d have gotten along well if each knew more about what really inspired the genius of the other. The following article link is as close as the internet would