Are You Exuberant?

I don’t think Jimi Hendrix and Alan Greenspan would have ever hung out, but I do think if they’d met by some kind of happy accident, they’d have gotten along well if each knew more about what really inspired the genius of the other. The following article link is as close as the internet would have me think this meeting ever came to be (read to the end for some foreshadow on the value of the US dollar): https://money.cnn.com/2003/07/… .

In December 1996, almost twenty-five years ago Alan Greenspan suggested markets were “irrationally exuberant.” As of this moment, I can’t think of a single current pundit suggesting that markets are rational, much less exuberant. It feels more like petulant than exuberant and individual investors need to be disciplined before they lose their shirts.

In 2007, a very dear client gave me a copy of Greenspan’s The Age of Volatility. It was the book that changed everything for me. It lifted the veil and made clear that what I’d been told in the eight years prior were half-truths, bent to meet an agenda. Greenspan’s story about how he, too, had been led to believe in a false construct, and admitting his mistake in doing so, spoke to me.

More recently (but still at least two or three years ago now), I read an interview where he (Greenspan, not Jimi), noted that interest rates could rise rapidly and significantly if lenders experienced substantial default levels again and collectively stopped buying the Fed’s charade (my words, not his). I have not seen anyone else say this before or since.

I cop to the accusations that I’m looking for this news. It’s not because I want it to be, but because I believe it will be.

Inflation or No Inflation, That Is the Question

The Fed is telling us there is no inflation, so they are going to keep rates low until they see evidence that it’s running hot. If you believe this, I have some magic beans you might be interested in.

Inflation has been a problem for years, just not in employee compensation. By the way, that’s when the government, or rather, the rich friends of government, will say it’s a problem.

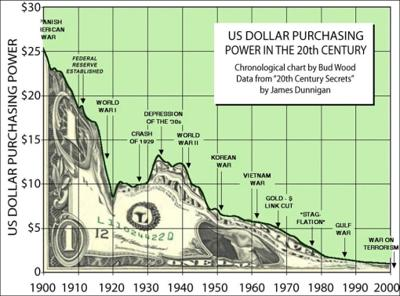

When we mention the word “inflation” to clients, it conjures thoughts of rising gasoline prices and postage stamps for many of them. This is a misnomer. Rising prices are a symptom of inflation. At its core, inflation is the erosion of value in a currency. Let’s explore that, shall we?

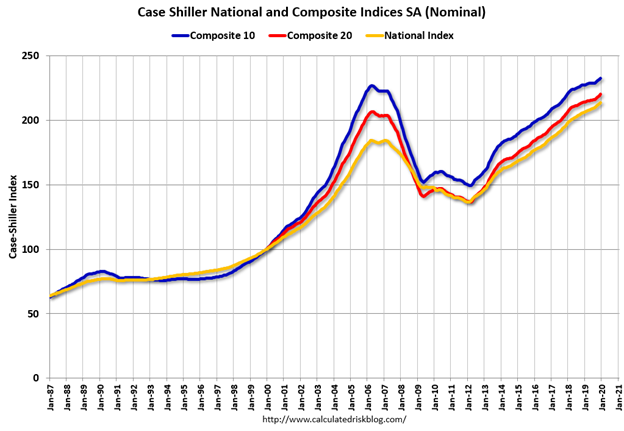

Chart cred: SeekingAlpha.com

If you need evidence of an inflationary bubble, look no further than the cost of housing.

There’s no temporary volatility for the fed to explain away here, though they have cleverly fudged the way they measure it in the CPI. Housing costs consume 30% of household income for Americans. When that cost goes up 14% in a year, that’s a crystal-clear indication of an inflationary bubble.

Here’s one more factoid: government borrowing, and spending, is inflationary by nature! Everything Congress and The Fed have done for the last twenty-plus years has been inflationary by design!

We were already in the late stage of the bubble when the stimulus reaction to the pandemic accelerated it exponentially. But the bubble is leaking now, as evidenced by commercial and residential mortgage debt default increase. Sooner than later, the government will not be able to hold lending institutions back, and residential foreclosure activity will increase to meet that of the current commercial mortgage marketplace. Whether the bubble will burst loudly, or deflate with a more slow, subtle hiss remains to be seen. However, every inflationary bubble eventually ends one way or the other. Nobody wants to believe it, so by law (of nature), it will surprise many. But not all.

Written

March 18, 2021

Read Time

3 min read

More Posts