Head Fake or Bursting Bubble?

Is the recent action in markets the beginning of a downturn, or just a temporary pause? That is the $64,000,000,000,000 question;$64,000 just doesn’t seem to do it justice anymore (yes, I know I’m dating myself here).

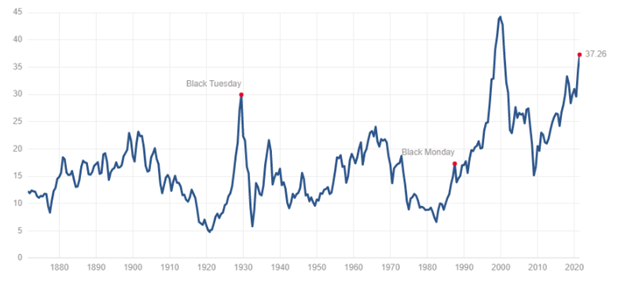

Mark Twain said, “History doesn’t repeat itself, but it does rhyme.” In the graph below, it may not be immediately apparent, but when you look at it closely, and for as long as we have, a distinct pattern emerges.

Shiller PE Ratio, https://www.multpl.com/shiller-pe[jl1]

In 1998, the hedge fund Long Term Capital Management collapsed after big bets on Russian government bonds went south. When losses went into the billions (which is nothing now), the US Government intervened with a bailout that allowed LTCM to liquidate in an orderly fashion. Then, at the end of 1999, with margin investing and the dot.com bubble nearing its peak (margin investing is where investors borrow money from their broker-dealer to invest more in stocks), buying paused before New Year’s Eve. After Y2K did not stop time, market prices resumed their climb until March, when the Tiger Fund collapsed (https://money.cnn.com/2000/03/30/mutualfunds/q_funds_tiger/). The NASDAQ tanked, and then nine months later, like a newborn Rosemary’s Baby, the S&P and The Dow went to Hell right along with it (https://www.investopedia.com/articles/mutualfund/05/hedgefundfailure.asp) .

In the summer of 2007, the Bear Stearns High Grade Structured Credit Strategies Enhanced Leveraged Fund (with a name like that it had to be good), collapsed. This was a fund of highly leveraged bets on Collateralized Debt Obligations, which is a fancy way of saying investors borrowed tons of cash to buy ridiculously risky bond securities. Bear Stearns managed to back away quietly, and market participants chose to chalk it up.

“Yes, there was too much leverage in the market. Yes, there was too much appetite for risk and yes, that risk was underpriced,” said Mark Adelson, a senior analyst at Nomura Securities in New York. “But there has not been a lick of spillover of this situation in the corporate bond market or stock markets, so I don’t think people need to start hoarding food, water, and ammunition because the end is coming.” (https://www.nytimes.com/2007/06/21/business/21bonds.html) Then about fourteen months later Bear and Lehman collapsed under the weight of their losses in mortgage-backed securities, and the GFC happened.

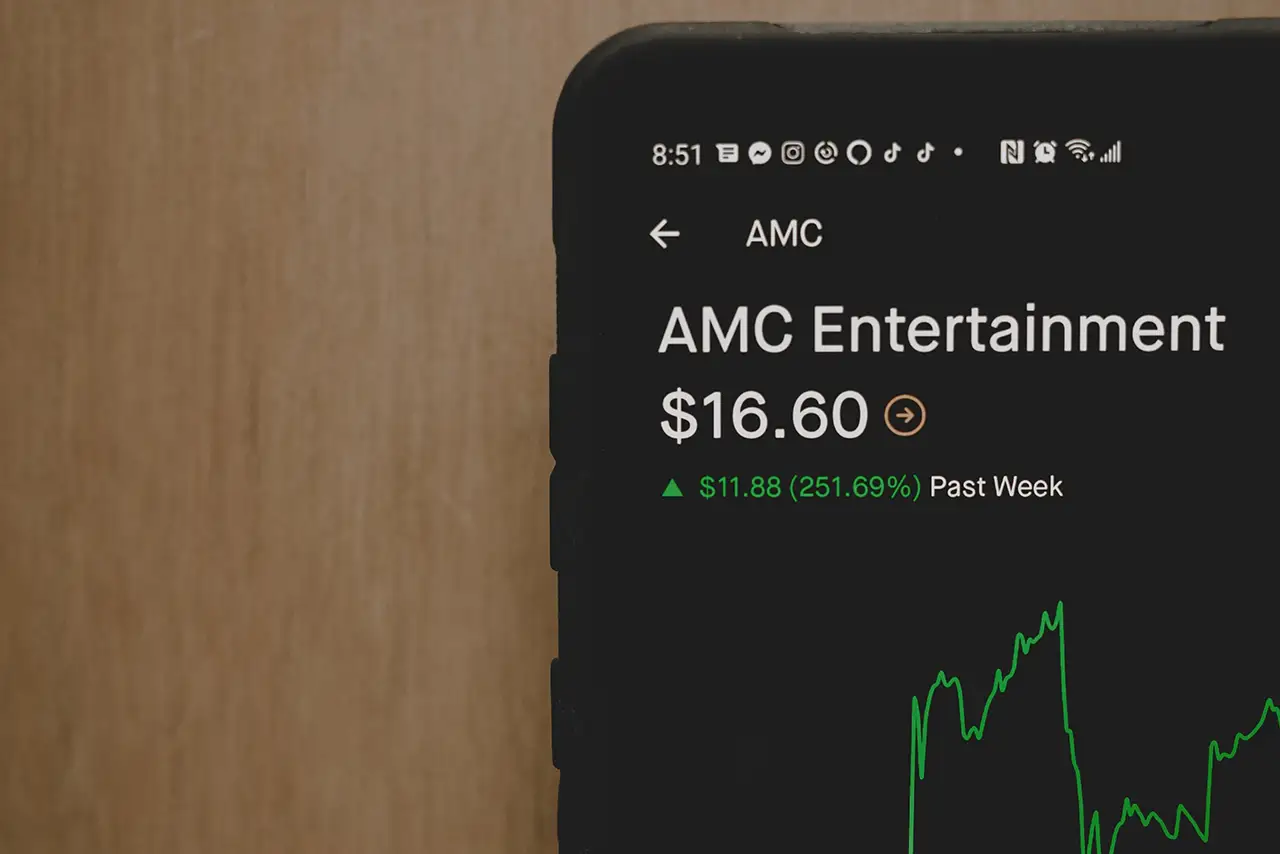

In March of 2021, Archegos Capital Management, a “family office” (it sounds so wholesome and friendly) that managed the personal assets of Bill Hwang, defaulted on margin calls from several global investment banks. The firm used opaque, but legal, financial machinations to help hide its high exposure to debt risk. A former manager in the Tiger Fund, (yup, the same Tiger Fund), in 2012, Hwang had plead guilty to insider trading and been banned from trading in Hong Kong.

In April of 2021, Greensill Capital collapsed under the weight of debt obligations, lawsuits for hiding financial problems, and court refusal to allow them to pass this risk off to an insurance company (https://www.nytimes.com/2021/03/28/business/greensill-capital-collapse.html). Before the collapse, Japanese investment lending giant, Softbank, plowed billions into it.

This week, Katerra Hedge Fund collapsed. Another SoftBank techno-debt unicorn, this one, reportedly, succumbed to the effect of inflating material and labor costs. Notably, in December last year, Katerra was bailed out by Greensill under pressure from big daddy SoftBank (https://wolfstreet.com/2021/06/01/softbank-funded-silicon-valley-unicorn-katerra-created-to-transform-the-construction-industry-runs-out-of-money-collapses/).

Are you hearing the rhyme? Catching the rhythm?

The bull market in broad market stocks could continue. Valuations could go right up to their pre-Y2K levels, or higher. But sooner or later, every debt binge ends with a bad hangover.

Prior to the pandemic, investors were leveraged so highly, the slightest ripple in cash flows would have caused some disruption in values; the pandemic expanded a ripple into a tsunami. And since then as it did preceding these other downturns, margin borrowing has soared to near all-time highs. Predictably, last March The Fed flapped their jaws about buying more debt, this time corporate and even junk bonds, to ease panic. Also predictably, under the cover of The Fed’s “announcement effect,” corporations took the opportunity to issue another $900 billion in new bonds.

When the defaults reach critical mass again, The Fed will go back to its one-trick pony show, and maybe that will ease the panic again. But sooner or later, that pony will tire out, and investors will not buy the head fake. Then we’ll know for certain the bubble has burst.

On a brighter note, if you’re reading this, you have likely followed our advice and are as well hedged against this risk as we know how you can be. Additionally, the cycle of asset bubbles we refer to here have contributed mightily to income inequality over time. When the dynamic under which they have been propagated has failed, we will have an opportunity to restructure in a more equitable and sustainable manner.

Written

June 4, 2021

Read Time

4 min read

More Posts