Our Best Defense, Our Greatest Weakness

Everything is relative. Perception is reality. It depends on how you look at it. The slipperiest of all slippery slopes is the one we begin to slide down when faced with a decision between good and bad and all the grades in between. Rationalization is the devil on our shoulder. Sometimes we know he’s there, egging us on. Sometimes we’re so caught up in the moment that we forget he’s there. Nudging. Always nudging.

This is not a religious statement. The devil is, of course, us. No one is on our shoulder. It’s our own self up there. Nudging. Rationalization creates a cloud of smoke our better judgement might not see through. Faster than a speeding bullet, and more powerful than a locomotive. If you’re asking how this relates to personal finance, you’re not a regular reader of this blog.

As we’ve said before, money is not math. Money is emotional. And as our most powerful defense mechanism, rationalization helps us to justify financial decisions our gut (or the spread sheet) tells us are not financially sound.

For example, when we talk to clients about investing in rental real estate, the first question we often get is “Would a condo in beach/ski Resortville that we can vacation in be a good investment?” Or when we talk about year-end tax planning, after telling someone they’re never going to pay a lower tax rate than they pay today unless they’re broke, they say “But I plan to live on less in retirement so shouldn’t I make the tax-deductible SEP IRA/401(k) contribution?” A condo we intend to sleep in will have costly features we’d never buy for someone we were renting to, and no, you will not live on less in retirement. I’ve been doing this for over twenty-five years and I can count on one hand the number of people who pay a lower tax rate in retirement than they did while working.

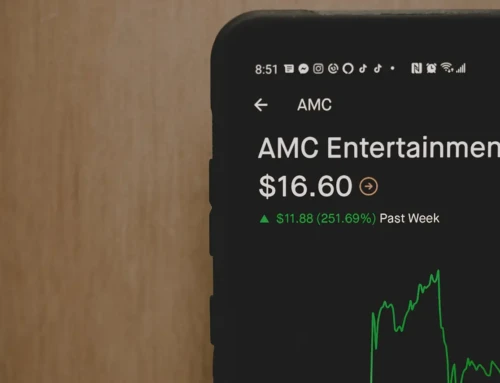

It seems there’s more rationalization going on right now than ever before. Market volatility is especially conducive to this and market volatility is likely to get worse before it gets sustainably better. That’s the bad news.

The good news is that, just like every other emotional aspect of humanity, we can learn ways to control our use of rationalization. In the first advisor training conference I ever went to, my coaches talked about the sequence of thoughts, feelings, and actions. They taught me that emotional intelligence is key to finding balance in our professional lives as advisors and in helping clients to make better financial decisions. When we have a thought that conjures feelings, before we act on them, the pause and reflect method can help us to recognize why that thought made us feel that way and reframe them.

Are you rationalizing your personal financial decisions? Probably. Could talking with an advisor help? Probably. Does your answer to those questions conjure feelings of anxiousness?

Pause and reflect.

Written

August 26, 2022

Read Time

3 min read

More Posts