What’s Next?

As a follow up to our last post, I thought we’d offer some perspective on what’s next for markets because we’re seeing a lot of half-baked messages on the internet. As I type, the US stock market is down 8% on the day, and I’m seeing weather forecasters and bartenders offering investment advice to people asking what they should do. What’s next for markets is anybody’s guess. What’s next for you is entirely within your control.

Markets

Nominal stock prices have tumbled about 18% from their February 19th high water mark as concerns over what effect COVID-19 may have on corporate earnings. That’s a hair-raising drop for even the most experienced investors. As we said in our last post (Are You Hedged?), while the economic impact of COVID-19 is sure to be significant (and I don’t care what any politician says, a complete weeks long halt in Chinese manufacturing is a major monkey wrench in the supply chain), our view is that this was just the final straw institutional market participants have been waiting for. In other words, if COVID-19 hadn’t come along, something else eventually would have.

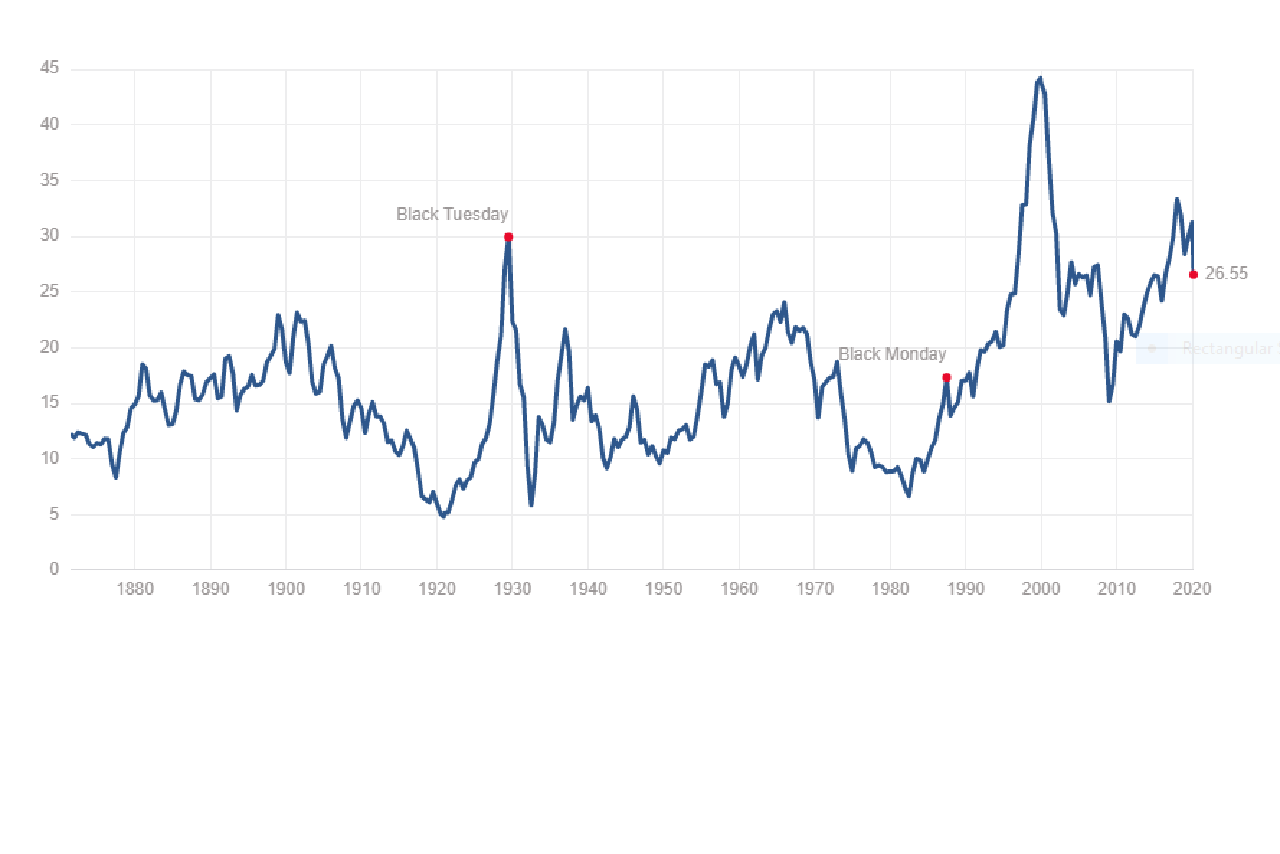

As gut wrenching as this roller coaster ride has been, the truth is, valuations are still very high. The chart below is called the Schiller PE Ratio, and it’s intended to represent the valuation of the US stock market, adjusting for cyclical economic changes over long periods of time. While as we say above, nominal stock prices hit an all time high on February 19th, actual value has been higher at two other points in modern history. In 1929 just before the Great Depression, and in year 2000 just before the dot com bubble burst. The historical average for market valuation is about 16.5 (that’s the PE ratio for those of you wondering and I’ll spare you the technical explanation of what that means, just know the average has been 16.5 for over a hundred years). Today we sit at about 26.5, and in every other long term market correction in our history, that PE ratio figure has gone below 16.5, which is what makes that 16.5 the average (half of the time the measure is well above 16.5, and half of the time it’s well below).

Bottom line, things could get a lot worse in markets before we hit a true bottom.

Oil

For one, oil prices dropped 30% at one point in trading today. What does that have to do with stock prices? Umm, everything. American oil producers (small hydro fracturing companies, not the mega cap oil processing companies like Exxon Mobil and Chevron, etc.), have borrowed so much money to leverage their cash flows, their debt made up over 30% of the junk bond markets last time we checked. Oil was over $62 a barrel on December 29th. Today it closed at a little over $31. When the price for a barrel of oil goes below $60, those companies are losing money daily. A lot of it. So, when oil does what it’s just done, the odds of these companies defaulting on their debt service payments increases dramatically. And then we have the falling debt domino chain we had in 2008-2009, except this time the Federal Reserve lowered interest rates to near 0% over a year ago, so who will bail markets out when the buyer of last resort can’t buy any more without causing runaway inflation? The answer: Congress. Yes, you heard me right, we are counting on Congress to pull us out of the fire this time around. I’m just going to let that sink in for a minute.

You

Now, full disclosure, don’t take this as a recommendation to sell all your stock investments. But hopefully, you didn’t have ALL your money invested in stocks when this thing began to unravel. If you do still have all your money invested in stocks, and you might need or want some of that money for other things (like a house, business start-up, or umm, groceries and your electric bill), as bad as things feel now, they could easily get a lot worse before they get better. If you have adequate cash reserves, and you’re pretty sure you won’t need the money you invested in stocks in the near term (like within the next ten years or so), then you may want to buckle up for the ride. Because getting off now could be treacherous.

Written

March 9, 2020

Read Time

4 min read

More Posts