School Days

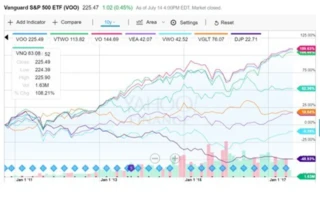

It’s that time of year: summer has ended, school is back in session, and many parents are beginning to think seriously about how they’ll pay for their children’s college education—a major expense with plenty of room for costly mistakes...