What Inflation Is All About?

Greetings From Snowy South Burlington!

We hope you all had a safe and relaxing Thanksgiving with friends and family. We double-checked the calendar this morning to see when winter officially starts because it sure feels like the switch has been flipped and winter is here now (if you were about to go search it yourself, the solstice is December 21st).

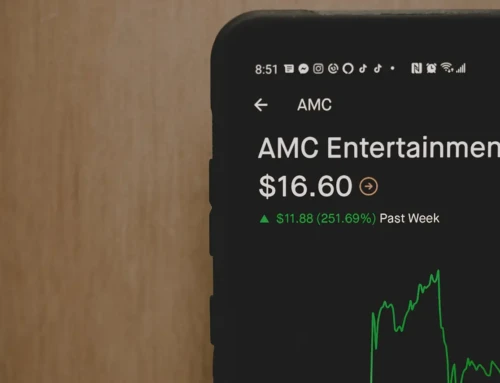

However, we didn’t write to talk about the weather today. We’re writing because we’ve been getting questions about Series I bonds recently. Series I bonds are US Savings Bonds that the government resets the interest rate on every six months, adjusting for inflation. And, well, you don’t need us to know inflation has been getting worse. If you spend money, you know a dollar doesn’t buy what it used to. Let us expand just a bit on this point.

As we’ve railed away about inflation being a primary economic concern for years, many of you have had images of rising gasoline prices and grocery bills when we say these words. But if you ask ten economists what inflation is, you’ll get ten different answers. Now I’m thinking of an exasperated Charlie Brown yelling, “Isn’t there anyone who knows what Christmas is all about?” Sure, Charlie Brown, I can tell you what inflation is all about…

Lights, please

And there were, in the same country, central bankers and Congressional budget officers, abiding in the committees, keeping watch over their policies by night.

And, lo, the law of supply and demand came upon them, and the intransigence of controlling shareholder greed shone round about them: and they were sore afraid.

And the Treasury Secretary said unto them, fear not: for behold, I bring you good tidings of great joy, which shall go to all top marginal bracket taxpayers.

For unto you is born this day in the city of Washington a partnership, which is the unification of The Treasury and The Federal Reserve.

And this shall be a sign unto you; ye shall find the partners wrapped in a never-ending quantitative easement, lying to the media.

And suddenly there was with the Treasury Secretary a multitude of legislators praising manifest global reserve status, and saying, “glory to deficit spending!” and on earth asset appreciation, beneficent tax law toward those who need it least.

That’s what inflation is all about, Charlie Brown.

Inflation in Layman’s Terms

Inflation is the erosion of value in a currency. Rising prices are a symptom of inflation, not the cause. When the Federal Reserve creates as many new dollars (8.5 trillion-ish), in ten years as were in circulation for a hundred or so before that, the flood of supply dilutes their value. Then when Congress takes that cash (through the sale of government bonds, to The Fed) and spends it, the buying they do drives prices up. The Central Bank and Congressional profligacy got us here. Charlie Brown and Linus will get us out.

Put a Few Pennies Aside Here

Go to https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm to put a few sheckles in something that will earn a little more than your local bank is paying you.

Go here https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm to learn more about how these bonds work.

Have questions? Contact us to arrange a complimentary consultation.

Written

December 8, 2021

Read Time

3 min read

More Posts